Escrow.com’s limitations on disbursement methods and currency handling are not just inconvenient—they’re out of step with modern, user-friendly payment standards. Given the strict guidelines against IBAN discrimination within the European Union, there is an urgent need for alternatives that cater to a more inclusive financial landscape.

note: Since escrow.com seems to be located in San Francisco in the US, EU guidelines possibly do not apply even when both parties are located in the EU.

In my experience, Escrow.com’s refusal to support reputable digital banking services like Wise, Revolut, and others—without providing clear justification—creates significant obstacles for users. Despite having well-established reputations and robust compliance, these services are sidelined by Escrow.com. This decision affects a large number of users, especially within the EU, where services like Wise are essential tools for minimizing cross-border transaction costs and improving accessibility.

Even after reviewing their official disbursement methods page at the time of writing this, it’s clear there is a lack of transparency. Nowhere does it explicitly mention the exclusion of Wise, Revolut or "third party payment services". Instead, users often find out the hard way—by being unable to complete their transactions. While reaching out to Escrow.com in reference to a current transaction, I received a snippet of their internal policy:

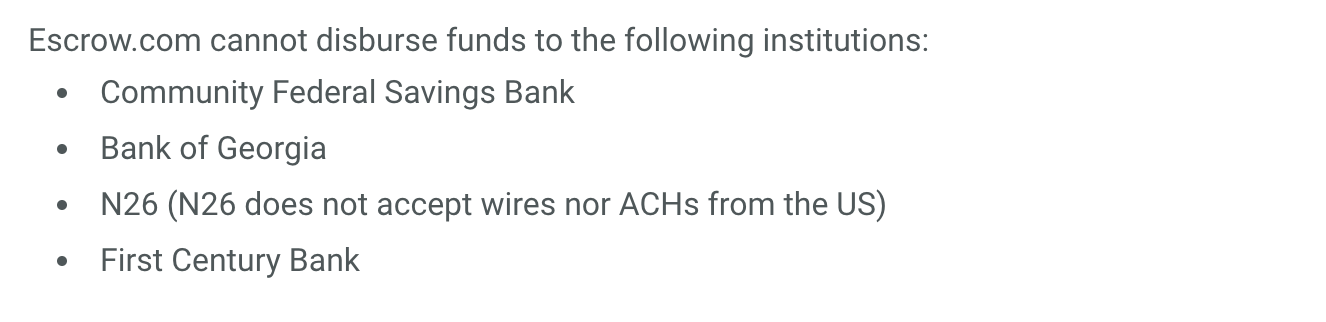

“Unfortunately, we no longer support disbursement to accounts under Wise, Revolut, N26, Community Federal Savings, Starling, Monzo, Bank of Georgia, Choice Bank LTD, Wirecard Solutions, Currency Cloud, Epayments, Paysera, First Century Bank, Evolve Bank & Trust, Payoneer accounts, digital banks or any other third-party payment service.”

This policy not only restricts choice but could also be seen as infringing on the EU’s anti-IBAN discrimination laws, from a EU perspective.

Additionally, when asked to simply disimburst to a EURO IBAN account at a local bank, they said since the buyer paid in USD, they could only disimburst in USD.

The lack of flexibility, combined with potential regulatory conflicts, makes a strong case for the emergence of viable alternatives in the EU market. These alternatives should support a wider range of modern banking services, respect SEPA guidelines, and offer transparent pricing. With growing demand for seamless international transactions, it’s high time the EU market had escrow services that embrace inclusivity and compliance, rather than impose outdated limitations.

If Escrow.com cannot adapt to these needs, it leaves a gap that competitors can—and should—fill. Such changes would not only comply with EU regulations but also align better with the expectations of today’s users who value choice, fairness, and transparency.